Credit Union in Wyoming: Discover the Benefits of Member-Focused Financial

Elevate Your Banking Experience With Cooperative Credit Union

Discovering the world of financial experiences can typically bring about finding concealed gems that use a revitalizing departure from traditional banks. Lending institution, with their focus on member-centric services and neighborhood participation, provide a compelling alternative to traditional financial. By prioritizing specific demands and cultivating a sense of belonging within their subscription base, credit score unions have actually carved out a specific niche that reverberates with those seeking a more tailored method to managing their finances. But what establishes them apart in terms of raising the financial experience? Let's dive deeper into the unique advantages that credit unions bring to the table.

Benefits of Credit Report Unions

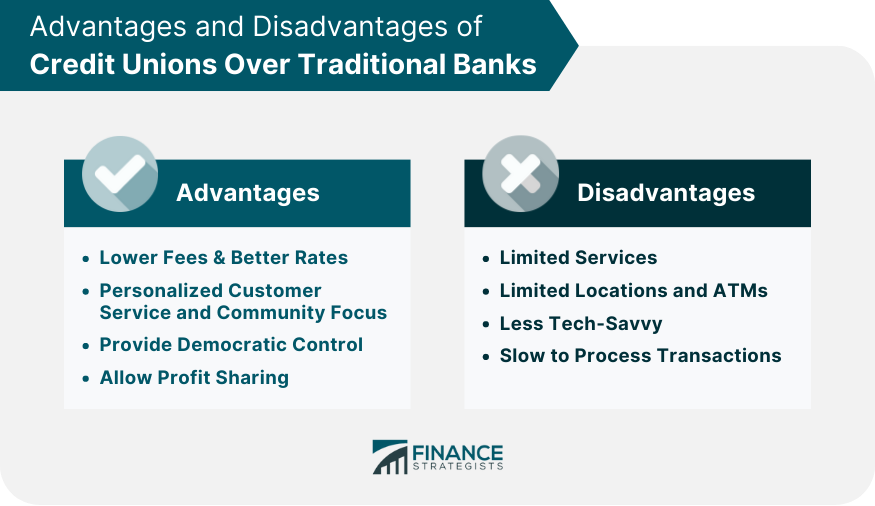

One more benefit of credit score unions is their democratic structure, where each member has an equal ballot in electing the board of supervisors. Credit scores unions frequently use monetary education and counseling to aid participants enhance their economic proficiency and make informed decisions regarding their cash.

Subscription Needs

Lending institution normally have particular standards that individuals need to fulfill in order to enter and accessibility their economic solutions. Membership demands for credit score unions frequently entail qualification based upon factors such as a person's place, company, business affiliations, or various other qualifying partnerships. Some credit unions might serve individuals that live or function in a certain geographic area, while others might be associated with specific companies, unions, or organizations. Furthermore, relative of current cooperative credit union participants are frequently qualified to sign up with as well.

To become a member of a cooperative credit union, individuals are typically needed to open up an account and maintain a minimal down payment as specified by the establishment. In some instances, there may be single subscription charges or continuous subscription dues. Once the membership criteria are met, people can enjoy the benefits of coming from a lending institution, consisting of accessibility to individualized economic services, competitive passion rates, and a focus on participant complete satisfaction.

Personalized Financial Providers

Individualized financial solutions tailored to specific requirements and preferences are a hallmark of cooperative credit union' commitment to member complete satisfaction. Unlike traditional financial institutions that usually provide one-size-fits-all options, cooperative credit union take a more personalized technique to handling their participants' finances. By recognizing the distinct objectives and situations of each member, credit scores unions can offer customized suggestions on savings, investments, financings, and various other financial items.

Additionally, credit scores unions typically offer reduced fees and competitive rates of interest on car loans and financial savings accounts, better improving the personalized financial services they give. By concentrating on individual needs and delivering customized services, lending institution establish themselves apart as trusted financial partners dedicated to assisting participants flourish financially.

Neighborhood Participation and Assistance

Neighborhood interaction is a cornerstone of credit scores unions' mission, showing their commitment to sustaining neighborhood campaigns and cultivating purposeful links. Cooperative credit union actively join neighborhood events, sponsor regional charities, and arrange economic proficiency programs to inform members and why not try these out non-members alike. By purchasing the areas they serve, cooperative credit union not only strengthen their partnerships yet likewise add to the overall wellness of society.

Supporting small companies is an additional means debt unions demonstrate their commitment to local areas. Via supplying bank loan and monetary recommendations, credit unions assist business owners prosper and promote economic growth in the area. This support exceeds simply monetary aid; credit report unions typically supply mentorship and networking possibilities to help tiny services do well.

In addition, cooperative credit union frequently take part in volunteer job, motivating their employees and participants to repay with different area service tasks - Credit Unions in Wyoming. Whether it's joining neighborhood clean-up occasions or organizing food drives, cooperative credit union play an active duty in enhancing the quality of life for those in requirement. By focusing on community involvement and support, cooperative credit union really embody the spirit of collaboration and mutual support

Online Banking and Mobile Apps

Credit score unions are at the center of this digital transformation, providing members safe and secure and convenient ways to manage their finances anytime, anywhere. On the internet financial solutions provided by credit report unions make it possible for participants to check account equilibriums, transfer funds, pay costs, and view transaction background with just a few clicks.

Mobile apps offered by lending institution better enhance the financial experience by offering extra adaptability and accessibility. Participants can perform numerous financial tasks on the go, Your Domain Name such as depositing checks by taking a photo, obtaining account alerts, and also getting in touch with consumer support straight via the application. The safety of these mobile apps is a top concern, with attributes like biometric authentication and file encryption methods to protect delicate details. Generally, lending institution' on-line banking and mobile applications encourage participants to manage their funds efficiently and safely in today's busy electronic globe.

Final Thought

In conclusion, credit scores unions supply a distinct financial experience that focuses on area involvement, personalized solution, and member satisfaction. With reduced costs, competitive interest rates, and customized economic services, credit unions provide to private requirements and advertise financial health.

Unlike banks, credit score unions are not-for-profit organizations owned by their participants, which often leads to decrease charges and better interest prices on savings accounts, financings, and credit scores cards. In addition, credit rating unions are understood you could look here for their individualized client service, with team participants taking the time to recognize the one-of-a-kind financial goals and challenges of each participant.

Credit scores unions typically offer economic education and therapy to assist members improve their financial literacy and make informed decisions concerning their cash. Some credit rating unions might serve individuals that function or live in a specific geographic location, while others might be affiliated with specific firms, unions, or associations. Furthermore, household participants of current credit history union participants are typically qualified to join as well.